When you are purchasing a boat there are an unlimited number of things to consider; what sails to get, mono or cat, fiberglass or metal, etc. One of those is, if you should own your own boat personally or through a company. Many people create an LLC for their new boat; however, there are some benefits and some disadvantages to this. I’ll post another blog detailing how Lisa and I created our LLC and all the work we put into it. For now I’ll try to lay out some of the things we considered, and why we finally decided to start an LLC.

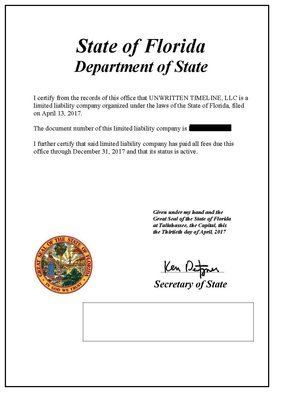

The biggest reason we decided to start an LLC for Unwritten Timeline is liability. A Limited Liability Company (LLC) is just that, it’s a company that can help to limit your personal liability. If something should ever happen while we are sailing around the world and we were to get sued an LLC would limit our liability to what the LLC owns. So we would lose the boat and all funding in the company, but we wouldn’t lose all our other personal assets and retirement accounts, being left destitute and unemployed.

Another way to protect your assets is insurance. Lisa and I will still carry insurance on the boat, and that will take care of the boat. It won’t always take care of everything, if we were to be sued for something. You could take some sort of umbrella policy as well to protect your other assets. Becoming an insurance pro to select the correct coverage would probably be about as much work as creating and running your boat as a business.

Another benefit of owning and operating your boat as a company is the tax advantages. You can write off depreciation and other deductions if you are running a business. Any savings you can make while you’re out sailing the world is a big help. The con to this approach is you have to actually run a business.

With the liability protection and tax benefits comes a lot of additional work. You can’t just start an LLC forget about it and expect it to hold up in court. If so, everyone would be running an LLC so they could protect everything they own. You have to actually open and run a business. This entails officially being recognized by the government as a business; filing articles of incorporation, getting any business licenses required, obtaining an EIN, etc. You have to keep business records of meetings, members, operating agreements, and a lot of other paperwork that a normal business would use. You have to run your finances in the same way. If you run your LLCs expenses out of your personal checking account it’s not a far stretch for a judge to determine that you don’t really have a completely separate business and are just trying to game the system for the protections which will leave you just as vulnerable as if you had no LLC.

Lisa and I have toyed with the prospect of running some sort of crewed charters or boat delivery service while we’re out sailing or even a school after we’ve completed the circumnavigation. Already having the LLC in place will allow us to do that when the time is right. Anything we do with the boat between now and then will also be a business expense or income. At the very least we get a minimal income from YouTube ads, Amazon Affiliate links, Zazzle sales, and someday we may use Patreon as well. All that income will go directly into our business checking account and Lisa and I can draw on that as it accumulates. More on that process in upcoming blogs.

Hopefully this and future blogs will provide a little insight into how you can run your boat in an LLC and some of the Pros and Cons to it. Of course contact a business lawyer and tax professional if you decide to start and run a business because I am definitely not a businessologist or a taxidermist.

The biggest reason we decided to start an LLC for Unwritten Timeline is liability. A Limited Liability Company (LLC) is just that, it’s a company that can help to limit your personal liability. If something should ever happen while we are sailing around the world and we were to get sued an LLC would limit our liability to what the LLC owns. So we would lose the boat and all funding in the company, but we wouldn’t lose all our other personal assets and retirement accounts, being left destitute and unemployed.

Another way to protect your assets is insurance. Lisa and I will still carry insurance on the boat, and that will take care of the boat. It won’t always take care of everything, if we were to be sued for something. You could take some sort of umbrella policy as well to protect your other assets. Becoming an insurance pro to select the correct coverage would probably be about as much work as creating and running your boat as a business.

Another benefit of owning and operating your boat as a company is the tax advantages. You can write off depreciation and other deductions if you are running a business. Any savings you can make while you’re out sailing the world is a big help. The con to this approach is you have to actually run a business.

With the liability protection and tax benefits comes a lot of additional work. You can’t just start an LLC forget about it and expect it to hold up in court. If so, everyone would be running an LLC so they could protect everything they own. You have to actually open and run a business. This entails officially being recognized by the government as a business; filing articles of incorporation, getting any business licenses required, obtaining an EIN, etc. You have to keep business records of meetings, members, operating agreements, and a lot of other paperwork that a normal business would use. You have to run your finances in the same way. If you run your LLCs expenses out of your personal checking account it’s not a far stretch for a judge to determine that you don’t really have a completely separate business and are just trying to game the system for the protections which will leave you just as vulnerable as if you had no LLC.

Lisa and I have toyed with the prospect of running some sort of crewed charters or boat delivery service while we’re out sailing or even a school after we’ve completed the circumnavigation. Already having the LLC in place will allow us to do that when the time is right. Anything we do with the boat between now and then will also be a business expense or income. At the very least we get a minimal income from YouTube ads, Amazon Affiliate links, Zazzle sales, and someday we may use Patreon as well. All that income will go directly into our business checking account and Lisa and I can draw on that as it accumulates. More on that process in upcoming blogs.

Hopefully this and future blogs will provide a little insight into how you can run your boat in an LLC and some of the Pros and Cons to it. Of course contact a business lawyer and tax professional if you decide to start and run a business because I am definitely not a businessologist or a taxidermist.

RSS Feed

RSS Feed